Can you make a deductible IRA contribution?

An IRA can be a great way to add to your retirement savings, but there are some (surprise surprise) complicated rules to navigate to determine if it’s a good idea.

A deductible IRA contribution happens when you deposit money into your traditional IRA and deduct that contribution on your tax return. It lowers your taxable income for this year, you can invest the money how you like, and it will grow (also tax-free) until retirement. At that point you will withdraw, or distribute, the money and pay the tax. Presumably you are in a lower tax bracket in retirement than in your working years, so it’s a good deal. For 2020, the maximum contribution is $6,000, plus an extra $1,000 if you’re over 50.

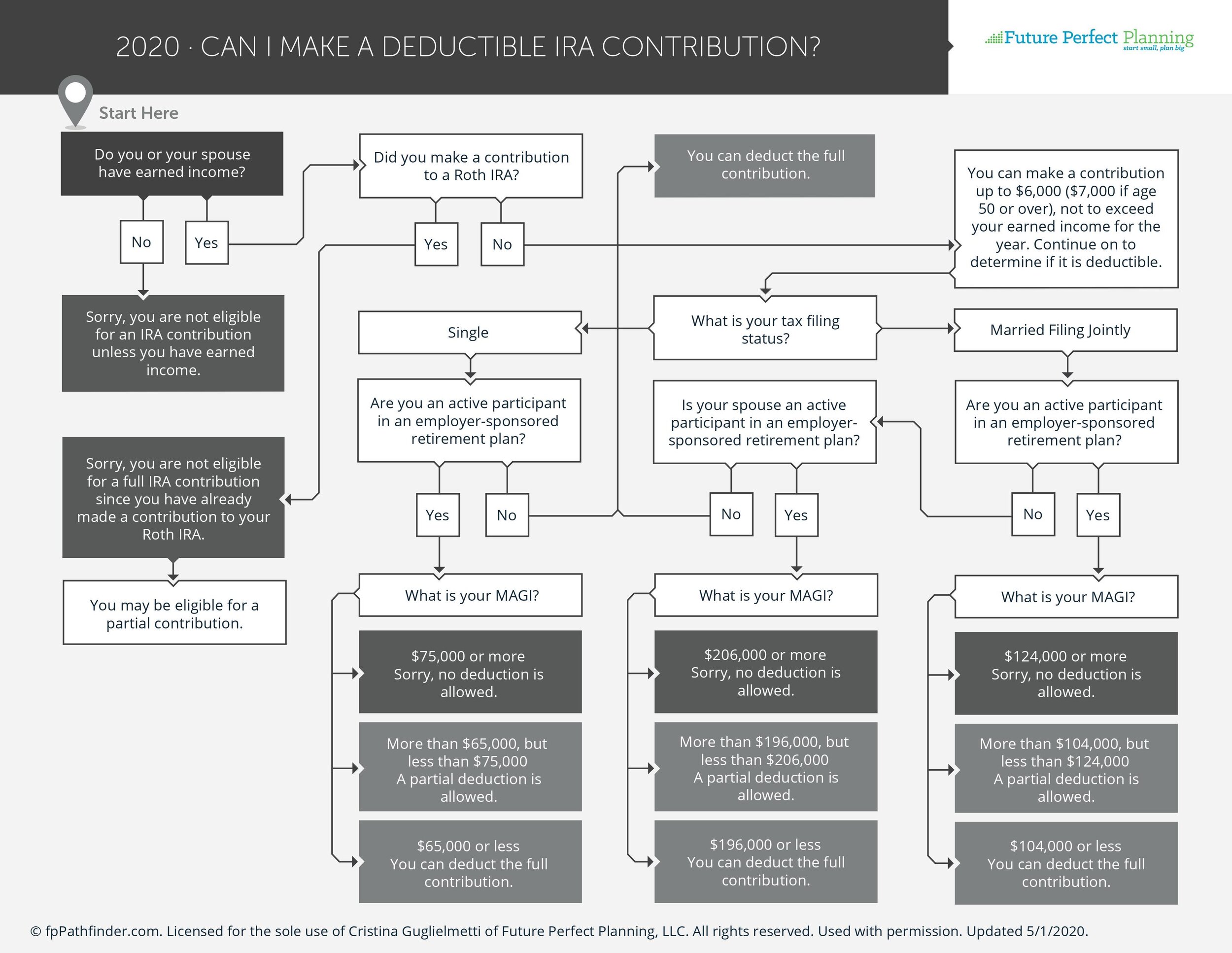

The first important point to remember is that anyone with earned income can make a traditional IRA contribution, but not everyone can deduct the contribution, which is generally the reason to contribute in the first place. There are various limits affecting deductibility, involving your income, your filing status, your access to an employer retirement plan, and whether your spouse (!!) has access to a plan at their job. The below flowchart guides you through the decision:

The second important point to remember is that you have until the filing deadline to make a contribution for a given year. So you can wait until you’re preparing your tax return and have the full set of information for the year before you decide whether to contribute. Also, you can make a different decision every year: situations and rules change, and what’s right for you now might not be best in a year.

The third important point: what does it mean to be an active participant in an employer-sponsored retirement plan? What if you didn’t contribute, but your employer did? Per the IRS, you’re covered by an employer retirement plan for a tax year if your employer (or your spouse’s employer) has a:

Defined contribution plan (profit-sharing, 401(k), stock bonus and money purchase pension plan) and any contributions or forfeitures were allocated to your account for the plan year ending with or within the tax year;

IRA-based plan (SEP, SARSEP or SIMPLE IRA plan) and you had an amount contributed to your IRA for the plan year that ends with or within the tax year; or

Defined benefit plan (pension plan that pays a retirement benefit spelled out in the plan) and you are eligible to participate for the plan year ending with or within the tax year.

The fourth important point is that even if it turns out that an IRA contribution isn’t beneficial for you this year, you can still save for retirement! You can earmark any kind of savings for retirement, so don’t let the deductibility question stop you from putting the money to work anyway: you can explore increased 401k or 403b contributions, a Roth IRA, saving in a taxable brokerage account, or accelerating your savings for a property purchase, as just a few examples of ways to increase your future net worth.

If you have made a contribution that turned out not to be deductible, what happens? Well, really, nothing. You haven’t broken any rules and you won’t owe a penalty. But you will have a mix of post- and pre-tax dollars in the account: the contribution you didn’t deduct (post-tax), and any contributions you did deduct plus the growth on the whole account (pre-tax). To keep them track of your non-deductible dollars, you’ll need to file IRS Form 8606. Otherwise, when you eventually distribute the money, you’ll be paying tax again on those dollars. So talk to an advisor to help figure out what the right move is for you.