Your 4th Quarter Checklist

The end of a deeply weird year is drawing closer, so let’s use the time to tie up some loose ends and make sure things don’t fall through the cracks.

Often, we set out at the beginning of the year with the intention to complete certain financial tasks: max out retirement contributions, for example, or adjust withholding and estimated tax payments so your underpayment or refund isn’t as large. But early in the year, it’s hard to predict what income will be, particularly if that income is derived partly or fully from self-employment. Expenses change too. And certainly 2020 brought a host of unexpected twists. But with only three months to go before the turn of the year, you have a much clearer picture of where things will land by the end of December, AND you have enough time to implement some changes if needed.

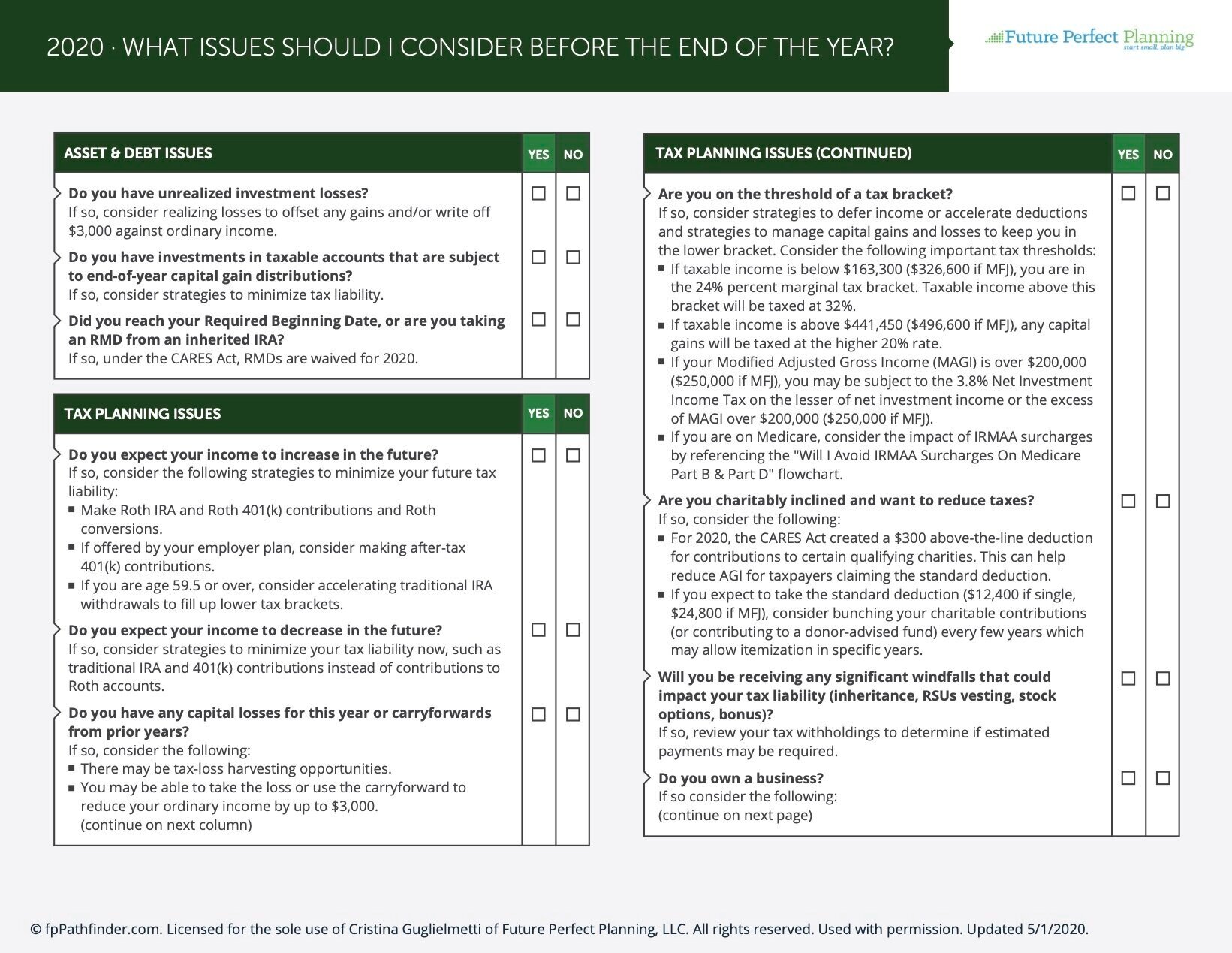

Below is a checklist you can use to get started. If you’re not currently a client and would like some assistance working though the list, contact me! If you are a current client, we’ll make sure it’s all covered.

In an upcoming post, I’ll talk about the idea of deduction bunching, as well as Donor Advised Funds, which are both mentioned in the checklist. This can be a surprisingly useful tax planning strategy!

Stay safe and healthy